Business Insurance in and around Simi Valley

One of Simi Valley’s top choices for small business insurance.

No funny business here

Your Search For Excellent Small Business Insurance Ends Now.

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Mishaps happen, like a customer hurts themselves on your property.

One of Simi Valley’s top choices for small business insurance.

No funny business here

Keep Your Business Secure

Planning is essential for every business. Since even your brightest plans can't predict natural disasters or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like extra liability and a surety or fidelity bond. Fantastic coverage like this is why Simi Valley business owners choose State Farm insurance. State Farm agent Paula Miller can help design a policy for the level of coverage you have in mind. If troubles find you, Paula Miller can be there to help you file your claim and help your business life go right again.

Do what's right for your business, your employees, and your customers by visiting State Farm agent Paula Miller today to ask about your business insurance options!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

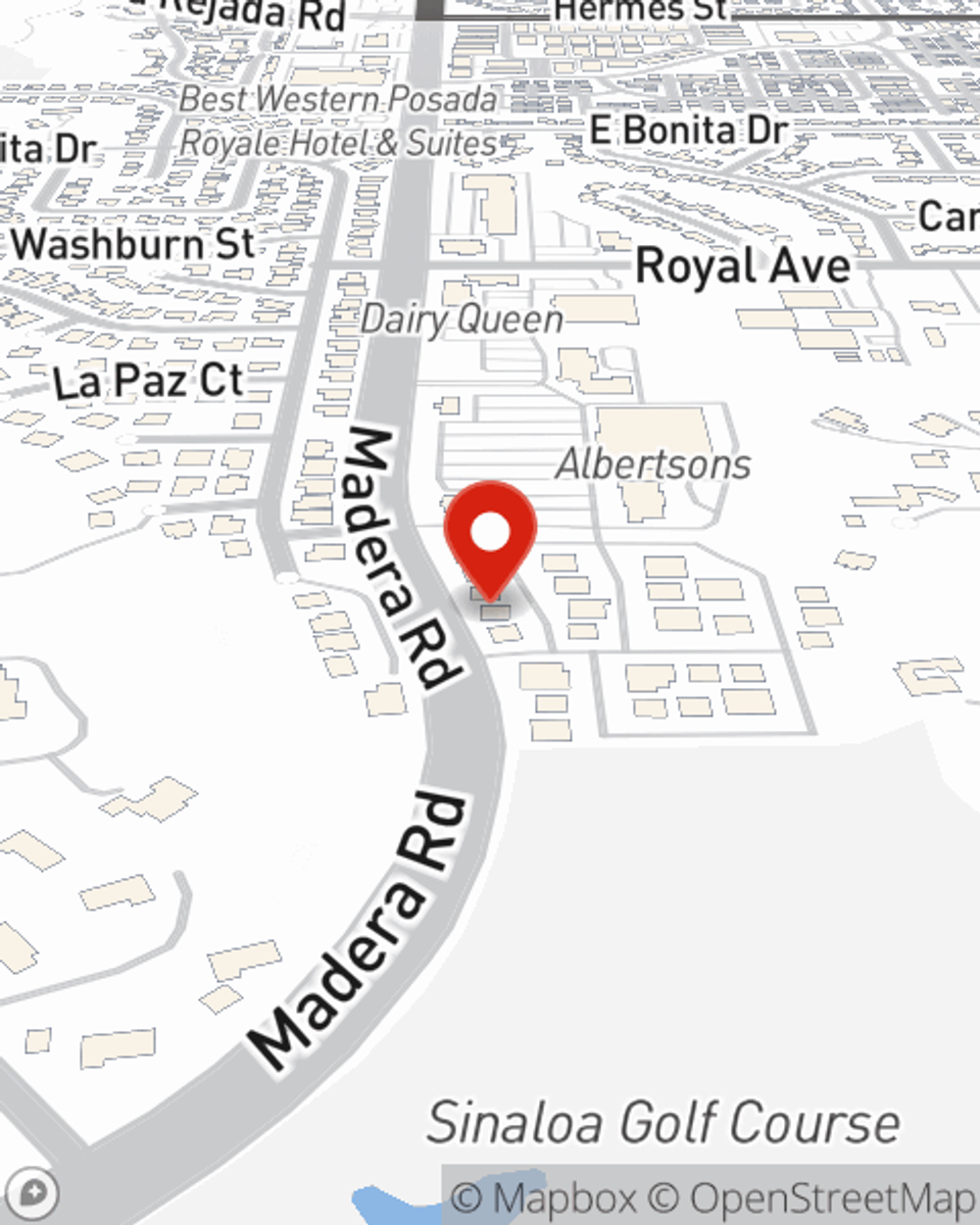

Paula Miller

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.